I love index funds and ETFs for their low-cost nature and simplicity of ownership. However, if you want to build generational wealth before traditional retirement age, consider looking beyond just index funds and index ETFs.

Since starting Financial Samurai in 2009, I’ve written extensively about investment strategies, financial independence, and retiring earlier to do what you want.

Based on years of reader surveys and conversations, it’s clear this community is one of the wealthiest on the web. A significant portion of you have already surpassed the $1 million net worth mark, while many more are closing in. In comparison, the median household net worth in America is only about $200,000.

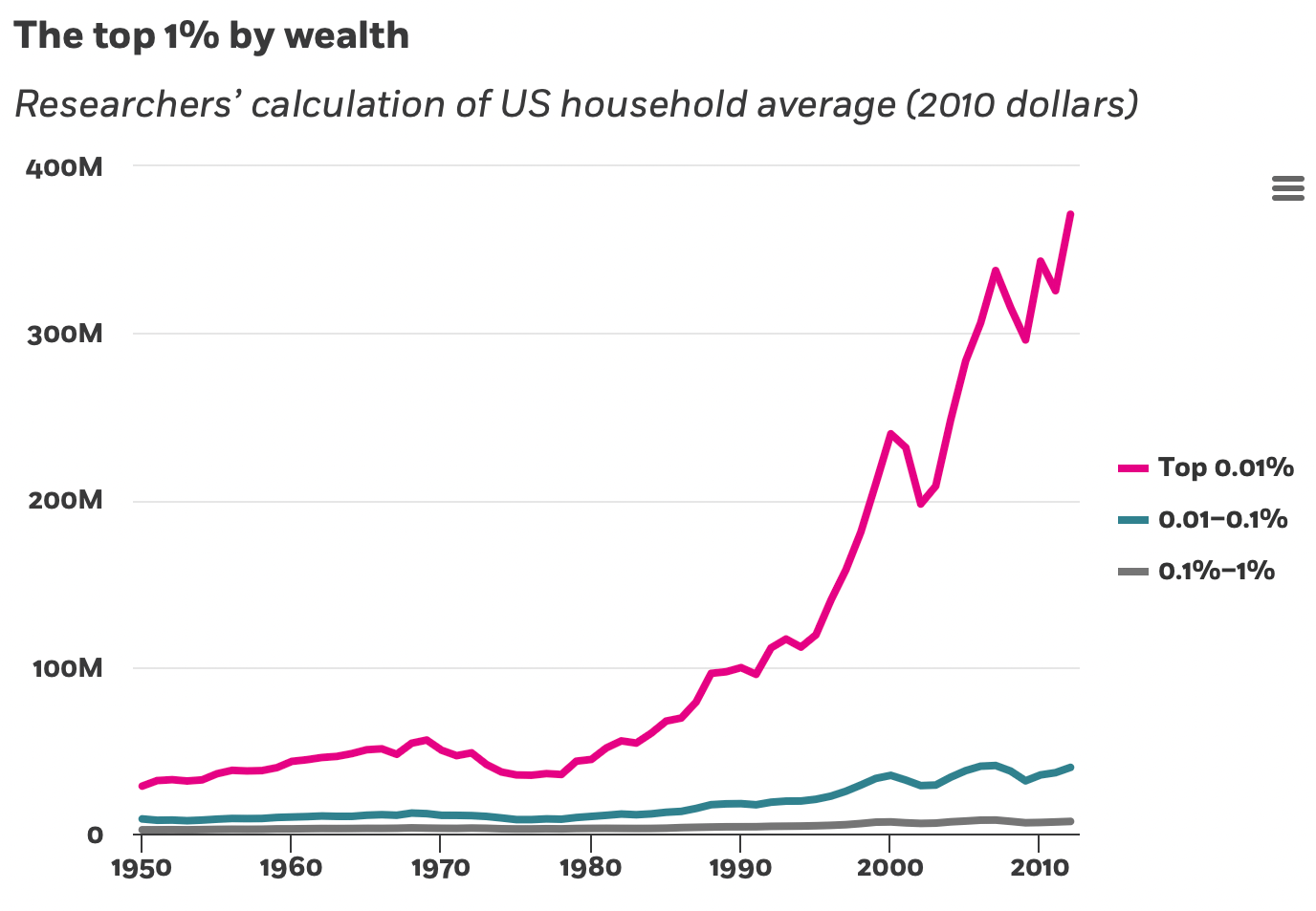

With this in mind, it’s time to acknowledge a simple truth: the richest people in the world don’t rely mainly on index funds and ETFs to build their fortunes. Instead, many use index funds primarily to preserve their wealth, not create it.

Why Index Funds Alone Aren’t Enough

Most of us love index funds for their simplicity, low fees, and historical returns. But if your goal is to achieve financial freedom before the traditional retirement age, or to reach a top 1% net worth, index funds alone probably won’t get you there before age 60.

To get rich sooner, you need either:

- A massive amount of income to consistently invest large sums into index funds, or

- To take more calculated risks in other asset classes

Simply put, index fund investing is best for capital preservation and slower, steadier growth. A potential 10% annual return is fantastic. But at that rate, your investment only doubles every 7.2 years. Hey, I’ll take it, and so would many of you. However, it’s simply not good enough for the richest people.

Your life is finite. Most of us only start working full time after age 18. Forty years might sound like a long time to build wealth, but trust me—it flies by. I’m 48 now, and I graduated college in 1999 at age 22. The past 26 years have zoomed past.

If I had only invested in index funds, I wouldn’t have been able to leave the workforce for good in 2012 at age 34. Don’t forget, there was a “lost decade” for both the S&P 500 and NASDAQ from 2000 to 2012. Relying solely on index funds would have delayed my financial freedom indefinitely.

Besides getting lucky, the only way to achieve financial freedom sooner than average is to take above-average risks by investing beyond index funds and ETFs.

The Average Rich Versus the Richest Rich

First off, if you’re rich—or think you’re rich—congratulations! You’re ahead of at least 90% of the world, which also means you’ve bought yourself more freedom than most. Although it’s tough, try not to let someone richer than your already-rich self get you down. The key is appreciating what you have.

That said, it’s important to distinguish between two types of rich, because they’re not the same. The personal finance community mostly focuses on the first kind—The Average Rich—partly because it’s easier to explain and attain, and partly because many financial influencers don’t have finance backgrounds.

In fact, the lack of financial depth in the space was one of the main reasons I launched Financial Samurai in 2009. Back then, nearly every blogger emphasized budgeting and saving their way to wealth. That’s solid advice for most people, however, I wanted to go beyond that.

I wanted to escape the finance industry altogether and retire early. That’s when I started writing about FIRE for the modern worker. With the internet making it possible to earn and live in non-traditional ways, I saw an exciting opportunity to pursue a different lifestyle.

Ironically, it was 2009—during the global financial crisis—when the digital nomad trend really took off, as millions found themselves out of traditional jobs and searching for something new.

Now let’s definite the two types of rich people.

1. The Average Rich

This group includes individuals or households with investable assets between $1,000,000 and $5 million. They tend to be highly educated, dual-income professionals who max out their 401(k)s, invest in low-cost index funds, and own their primary residence.

Most of their investments are in public markets and real estate, and they typically feel financially stable but not truly rich. Some would describe this as the mass affluent class. Many started off or are HENRYs (High Earners Not Rich Yet), but then often slow down their pace of wealth accumulation once kids arrive.

You might think of the everyday rich person as someone with grey hair, a portly figure, and retiring around the more traditional age of 60–65. They’ve got a median-priced home and might fly Economy Plus if they are feeling particularly spendy. They aren’t eating at Michelin-star restaurants, except maybe for a rare special occasion, like a 30-year wedding anniversary.

The Average Rich know they’re wealthier than most, yet they still don’t feel rich. Instead, they feel closer to the middle class than to the truly wealthy.

2. The Richest Rich

These are the people with $10 million-plus in investable assets, often owning second and third vacation homes, flying first class, and making seven-figure investments. Their kids mostly go to private grade school, which they can comfortably afford without financial aid.

Instead, their money came from:

They might own index funds, but it wasn’t a driver for them to get rich. Instead, index funds are a place where they park their money, almost like a cash plus, until they find a potentially better opportunity.

20% plus or minus moves in the S&P 500 don’t phase them as the Richest Rich often experience much more volatile swings. In fact, the Richest Rich often have investments go to zero as they continuously fortune hunt for the next multi-bagger investment. So often, index funds and ETFs are a small percentage of their overall net worth (<20%).

The Richest Rich Tend To Be Seen as Eccentric

The Richest Rich are often viewed as eccentric, agitators, or downright weird by the general public. That’s because they tend to reject the status quo and do things their own way. As a result, they attract critics—sometimes lots of them—simply for not following societal norms.

They refuse to spend their entire careers working for someone else to make that person rich or organization rich. Instead, they bet heavily on themselves through entrepreneurship and alternative investments. Index funds and ETFs? Boring. Too slow. These folks would rather build something from scratch or swing for the fences.

Many of the Richest Rich also go all-in on optimizing their bodies and minds. They train hard, eat clean, and track every metric they can—often in the hopes of staying fit enough to extend their grind and lifespan.

To most, they come across as quirky or intense. But from their perspective, it’s the rest of society that’s asleep, trapped in a system they’ve managed to escape.

Real-World Net Worth Breakdowns

Here are a few anonymized examples of the Richest Rich:

Example 1 – $30 Million Net Worth

- 30% ownership in business equity they started

- 30% real estate

- 20% public equities (65% individual stocks, 35% S&P 500 index funds)

- 15% venture capital funds

- 5% muni, Treasury bonds, cash

Example 2 – $300 Million Net Worth

- 40% ownership in business equity they started

- 20% real estate

- 20% in other private companies

- 15% stocks (half in index funds)

- 5% cash and bonds

Example 3 – $600 Million Net Worth

- 5% ownership in a massive private money management firm as one of their senior execs

- 15% real estate

- 50% in other private companies

- 10% stocks (half in index funds)

- 20% cash & bonds (~$180 million at 4% yields a whopping $6.4 million risk-free a year today)

None of them got rich by only investing in index funds. Instead, index funds are simply a low-risk asset class to them where they can park money.

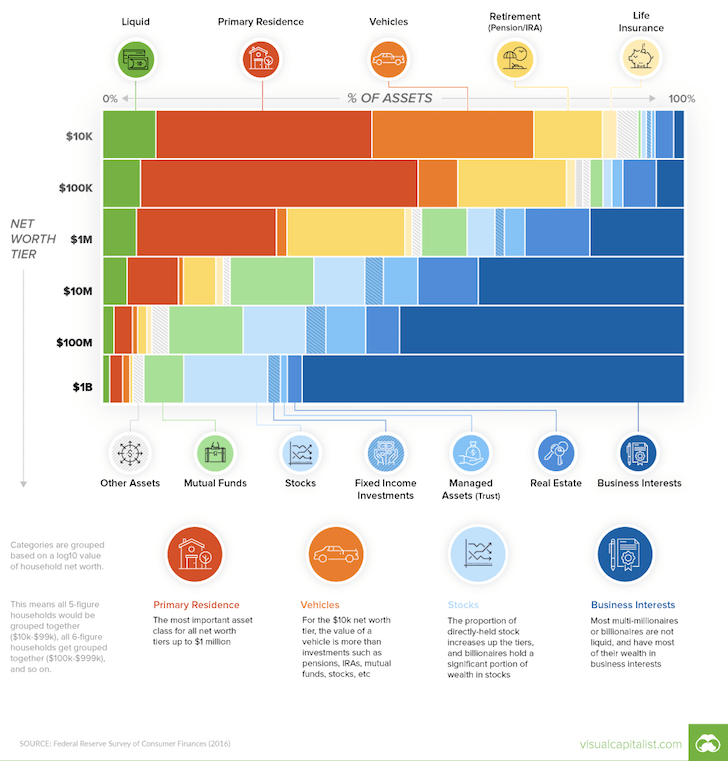

Net Worth Breakdown By Levels Of Wealth

Here’s a good net worth breakdown visualization by net worth levels. The data is from the Federal Reserve Board Of Consumer Finances, which comes out every three years.

Let’s assume the mass affluent represented in the chart below is at the $1 million net worth level. Roughly 25% of the mass affluent’s net worth is in their primary residence, 15% is in retirement accounts, 10% is in real estate investments, and 12% is in business interests.

In comparison, for the Richest Rich ($10M+), at least 30% of their net worth is in business interests. Intuitively, we know that entrepreneurs dominate the wealthiest people in the world. Therefore, if you want to be truly rich, take more entrepreneurial risks and investment risks.

Time + Greater Risk Than Average = Greater Wealth

Building meaningful wealth often comes down to how much risk you take—and how early you take it. When you’re young, lean into bigger bets. Invest in yourself. Build something. Own something beyond just index funds. If you lose money, you’ve still got time to earn it back—and then some.

If I could rewind the clock, I would’ve taken more calculated risks in my 20s and early 30s. Rather than playing it relatively safe, I would’ve gone bigger on business opportunities and leveraged more into real estate. I also would’ve made larger, concentrated bets on tech giants like Google, Apple, Tesla, and Netflix. The CEO of Netflix, Reed Hastings, spoke at my MBA graduation ceremony in 2006 when the stock was only $10 a share.

In addition, I would have started Financial Samurai in 2006, when I graduated business school and came up with the idea. Instead, I waited three years until a global financial crisis forced me to stop being lazy.

But honestly, I was too chicken poop to invest more than $25,000 in any one name—even when I had the capital to put $100,000 in each before 2012. The scars from the dot-com bust and the global financial crisis made me hesitant, especially after watching so many wealthier colleagues get crushed.

Still, I still ended up saving over 50% of my income for 13 years and investing 90% of the money in risk assets, most of which was not in index funds. I’ve had some spectacular blowups, but I’ve also had some terrific wins that created a step function up in wealth.

Don’t Be Too Easily Satisfied With What You Have

One of the keys to going from rich to really rich is pushing beyond your financial comfort zone—especially while you’re still young enough to bounce back from mistakes.

You’ve got to be a little greedier than the average person, because let’s face it: nobody needs tens or hundreds of millions—let alone billions—to survive or be happy. But if you’re aiming for that next level of wealth, you’re going to have to want it more and take calculated risks others won’t.

I was satisfied with a $3 million net worth back in 2012, so I stopped trying to maximize my investment returns. Big mistake. The economy boomed for the next 10 years, and I missed out on greater upside.

Then in 2025, after another short-term 20% downturn, I shifted my taxable portfolio closer to a 60/40 asset allocation. The temptation of earning 4%+ risk-free passive income was too strong. From a pure returns perspective, that’ll probably turn out to be another mistake long term.

To balance things out, I’ve deployed a dumbbell strategy—anchoring with Treasury bills and bonds on one end, while taking bolder swings in private AI companies on the other. And you know what? It feels great. I get to sleep well at night knowing I’ve got protection on the downside, while still participating in the upside if the next big thing takes off.

Final Thought On Investing In Index Funds And ETFs

Index funds are great. I own multiple seven figures worth of them. You should too. But they are best suited for those on the traditional retirement track or those looking to preserve wealth.

If you want to achieve financial freedom faster or join the ranks of the Richest Rich, you’ll need to invest beyond index funds. Build something. Take risks. Own more of your future.

That’s how the richest people do it.

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan. The richest people in the world get regularly financial checkups.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

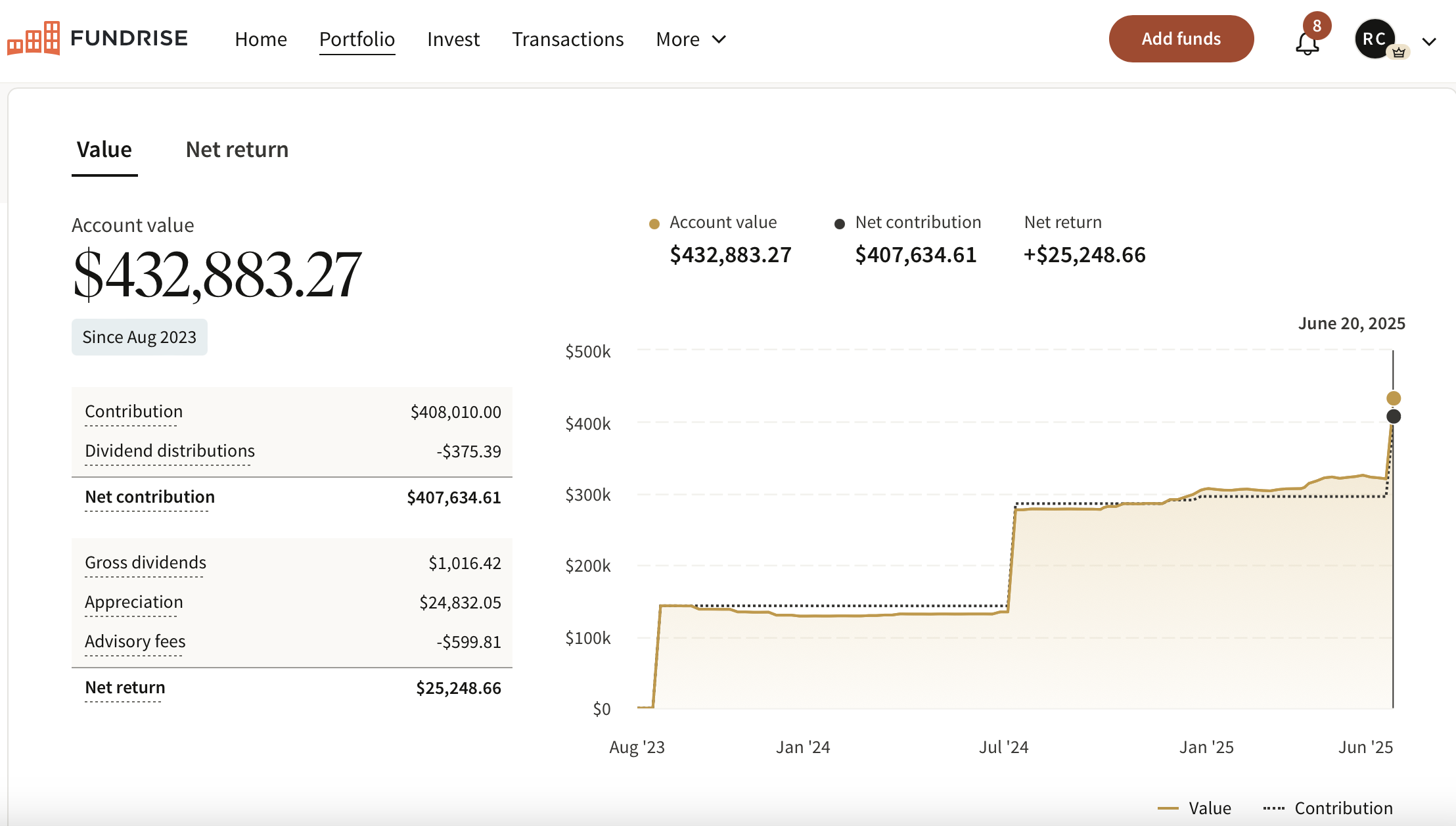

Diversify Your Retirement Investments

Stocks and bonds are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher. As the Federal Reserve embarks on a multi-year interest rate cut cycle, real estate demand is poised to grow in the coming years.

In addition, you can invest in Fundrise Venture if you want exposure to private AI companies like OpenAI, Anthropic, Anduril, and Databricks. AI is set to revolutionize the labor market, eliminate jobs, and significantly boost productivity. We’re still in the early stages of the AI revolution, and I want to ensure I have enough exposure—not just for myself, but for my children’s future as well.

I’ve personally invested over $400,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

To increase your chances of achieving financial independence, join 60,000+ readers and subscribe to my free Financial Samurai newsletter here. Financial Samurai began in 2009 and is the leading independently-owned personal finance site today. Everything is written based off firsthand experience.

Read the full article here