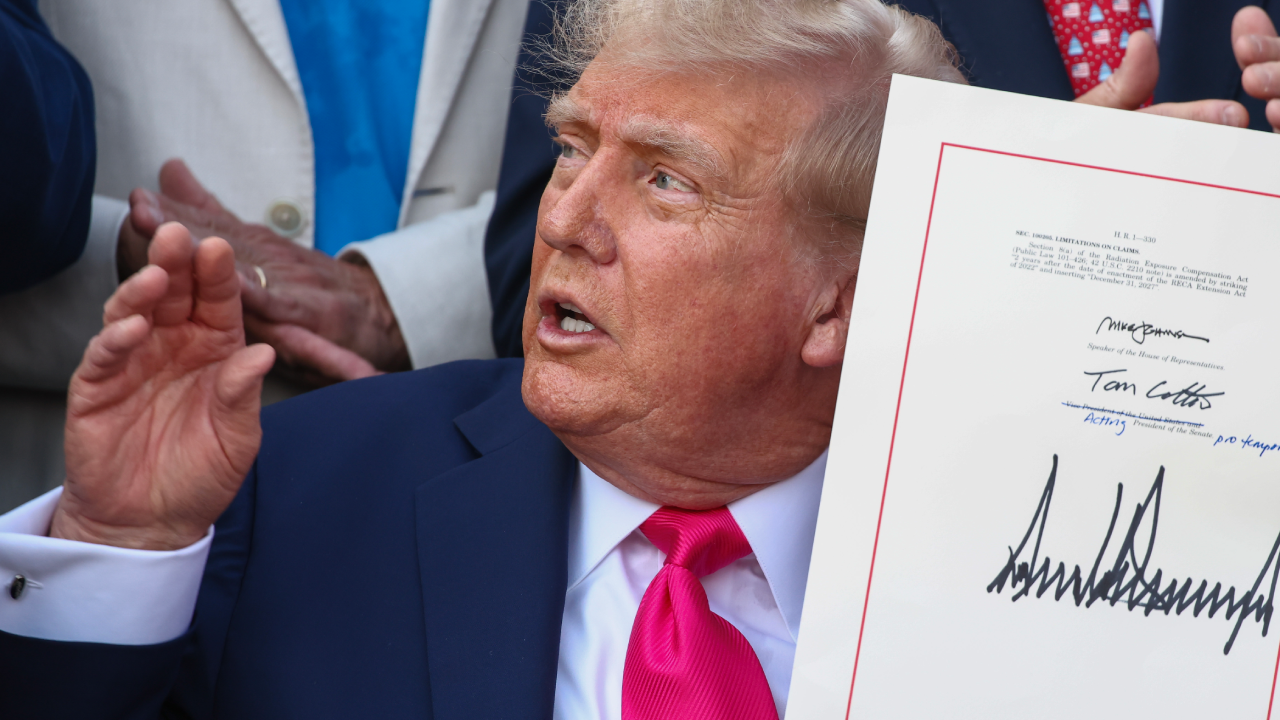

Americans may soon see a wave of tax changes — some as early as this year, others rolling out in future tax seasons. These updates stem from the massive tax bill recently signed into law by President Donald Trump.

The new legislation includes several key tax rules: an extension of many of the provisions of the 2017 Tax Cuts and Jobs Act (TCJA), an expanded child tax credit, a larger standard deduction for seniors, tax breaks for workers who receive tips and overtime pay, and more.

But not all of these provisions will take effect at the same time — and some are permanent while others are temporary.

Here’s a summary of when some of the key tax provisions go into effect — and expire.

A timeline of key tax breaks

| Tax provision | Effective date | Temporary or permanent |

|---|---|---|

| SALT deduction cap raised to $40,000 | 2025 through 2029 | Temporary (cap drops to $10,000 in 2030) |

| Auto loan interest deduction of up to $10,000 | 2025 through 2028 | Temporary |

| Bonus deduction of $6,000 for people aged 65 and older | 2025 through 2028 | Temporary |

| No tax on tips and overtime pay | 2025 through 2028 | Temporary |

| New charitable contribution deduction for people who don’t itemize | 2026 | Permanent |

| Elimination of electric vehicle tax credits | Sept. 30, 2025 | Permanent |

| Elimination of residential clean energy and energy efficient tax credits | Dec. 31, 2025 | Permanent |

| Higher child tax credit of $2,200, with annual inflation adjustments | 2025 | Permanent |

| Increased standard deduction (TCJA amounts made permanent, plus new inflation adjustment for 2025) | 2025 | Permanent |

| Reduced income tax rates (TCJA rates made permanent, plus new inflation adjustment added) | 2026 | Permanent |

| Qualified business income deduction of up to 20% made permanent (otherwise would have expired after 2025) | 2026 | Permanent |

2025: Tax changes that could put more money in your pocket

Beginning in 2025, millions of Americans could begin benefiting from a wide range of new tax breaks.

One of the most notable changes is the expanded state and local tax (SALT) deduction, which increases the cap from $10,000 to $40,000. The change will provide meaningful relief to taxpayers in high-tax states such as New York, California, and New Jersey. The increased SALT cap will be adjusted annually for inflation but is set to drop back to $10,000 in 2030 unless extended by Congress.

Another provision beginning in 2025 allows taxpayers to deduct up to $10,000 in auto loan interest for qualifying vehicles — new cars purchased for personal use and with final assembly in the U.S. The deduction applies to loans issued from 2025 through 2028.

Seniors will be eligible for a bonus deduction of up to $6,000. Meanwhile, service workers could benefit from a new exclusion of up to $25,000 in reported tip income, while employees who work overtime may qualify for a deduction of up to $12,500, or up to $25,000 for married couples filing jointly.

“These new tax provisions could bring about meaningful changes for taxpayers starting in 2025,” says Tracey Carney, a certified public accountant in New Orleans. “Now is the time to review how these updates might impact your finances and consider meeting with a qualified tax professional to plan ahead.”

2026: More changes ahead, including health care impacts

Several tax changes, including extensions of TCJA provisions, are set to begin in 2026. That said, taxpayers may not notice some of these changes that much, because many of these new provisions are simply continuing what is already in effect for 2025.

The 2017 TCJA, passed during Trump’s first term, made sweeping changes to the tax code. However, many of its provisions were set to expire after 2025. The new law makes several of those provisions permanent and extends them beyond Dec. 31 of this year. Some of those tax rules include reduced income tax rates, the limit on deducting mortgage interest on debt up to $750,000 and the qualified business income deduction.

The new law also makes two significant changes related to health care and taxes beginning in 2026.

“There are two overlooked elements of the big beautiful bill that can have major tax implications for your health care,” says Whitney Stidom, vice president of consumer enablement at eHealth, an independent insurance advisor. “One impacts how health insurance subsidies are calculated, and the other changes who qualifies to use a health savings account.”

The law modifies rules for Affordable Care Act (ACA) subsidies, which help reduce premiums for lower-income Americans. Under the new rules, individuals who earn more than 400 percent of the federal poverty level may still qualify for subsidies, but any excess subsidies received must be repaid in full when filing taxes.

“In the past, there was a cap on how much of the overpaid subsidies you had to return,” Stidom says. “Now, you may have to repay the full amount.”

The law also expands eligibility for health savings accounts (HSAs), allowing more health insurance plans — specifically, catastrophic and bronze-tier ACA marketplace plans — to qualify. An HSA allows people to stash money into a tax-advantaged account for qualified medical expenses, but you can only have an HSA if you also have a qualified high-deductible health plan.

For 2025, people can contribute up to $4,300 for themselves into an HSA and the amount increases to $8,550 for families. People aged 55 or older can add a $1,000 catch-up contribution to those amounts.

“There are about 7 million Americans currently enrolled in bronze plans who haven’t been able to use an HSA,” Stidom says. “This change could offer significant new tax benefits.”

Some tax breaks will now expire this year

The sweeping legislation also ends several clean energy tax credits, but on different timelines.

The popular electric vehicle (EV) tax credit is set to expire on Sept. 30. After that date, the credit will no longer be available. Originally introduced in 2008, the credit was expanded under President Joe Biden’s Inflation Reduction Act of 2022, offering up to $7,500 for new EVs and $4,000 for used models.

“If you’re considering buying a vehicle, now is the time to buy an electric vehicle,” Carney says. “Unless Congress extends the credit in the future, buyers won’t have the chance to take advantage of it once it’s gone.”

Other credits — specifically, the energy efficient home improvement credit and the residential clean energy credit — are now scheduled to end after 2025.

Until the end of the year, taxpayers can claim up to $3,200 per year for eligible improvements to their primary residence under the energy efficient home improvement credit. The credit covers 30 percent of qualified expenses, such as for installing energy efficient doors and windows.

The residential clean energy credit allows taxpayers to claim 30 percent of the cost for new qualified clean energy property — including solar panels, solar water heating systems, geothermal heat pumps and more. These credits are nonrefundable, meaning they cannot reduce your tax bill below zero.

Bottom line

Carney recommends that taxpayers review both expiring tax provisions and new ones that may apply to their situation.

“Whether it’s making qualified home improvements to lower your tax liability or maximizing overtime pay this year, being strategic with your tax planning can lead to big savings when you file your 2026 return,” she says.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here