I have wanted to lose 10 pounds (~6% of body weight) ever since I started Financial Samurai in 2009. I have come close, dropping five to six pounds in some years, but never quite hitting the double digit goal. As a result, for more than 16 years, I failed to accomplish something that should have been straightforward, especially for a supposedly rational economist and personal finance nerd.

There were even moments when I considered intentionally gaining a lot of weight just to make losing 10 pounds easier. The idea felt similar to racking up a ton of credit card debt to enjoy life to the fullest, then celebrating once it was all paid off. I saw people do this online and get praised like heroes.

Instead of deliberately gaining weight, I eventually decided it was healthier to just lose weight. And surprisingly, all it took was finally applying two economic principles: reduction and substitution. Once I did, the weight came off in six months.

The Basic Economic Principle of Reduction

As the price of a good rises, the quantity consumed tends to fall. This relationship is clearly illustrated by the classic supply-and-demand curve.

If each meal costs $25 and I have $100 to spend on food, I can buy four meals. If the price per meal rises to $33.34, that same $100 only buys three meals. With a fixed budget, the rational consumer must reduce consumption by about 25–30 percent.

Where we get into trouble financially is ignoring this principle. Instead of adjusting behavior, we pay $134 for four meals, absorb the higher cost, and then complain about food inflation.

A more constructive response is to use higher prices as a forcing function to consume less. Fewer meals out can help us stay within budget and, in many cases, improve our health as well. Lower spending and better discipline is a win-win outcome.

Yes, combatting inflation is straightforward but not easy. As investors, we’ve been able to make handsome returns in recent years, thereby making it easier to splurge on food. However, as a rational economist, you change your behavior if you want to change your outcome.

We Should Have Consumed Less Food During The Pandemic

Based on the simple economic principle that higher prices should reduce consumption, I should have lost a ton of weight during the pandemic.

Instead, starting in 2020, our food spending climbed rapidly as we ordered more delivery. At the time, it made sense. Delivery saved time and reduced exposure risk, especially since our daughter was born in December 2019 and had a still-fragile immune system.

The problem is that food delivery typically costs about 20% more than picking up the same meal and roughly 50% more than cooking at home. With a newborn and a three-and-a-half-year-old, we justified the premium as a necessary time saver.

Five years later, we were still ordering delivery regularly. Not only is it expensive, but restaurant food is also generally less healthy, with higher levels of added sugar and salt.

The Catalyst To Finally Start Losing Weight: Less Money

To lose weight, it helps to have a catalyst. Mine was spending five weeks with my parents in July 2025. My dad, who is about six feet tall and weighs roughly 155 pounds, called me chubby. Thanks dad. I fired back that he should put on some weight and muscle.

But deep down, I knew I could stand to lose some weight. At the time, I was five foot ten and weighed 172 pounds. There is nothing like going to Hawaii and having to take your shirt off at the beach to make you confront excess weight. If you are no longer trying to attract a mate, the natural tendency is to let yourself go because you already have one.

Because we stayed with my parents, we saved at least $20,000 in lodging costs. Initially, I only had food and transportation expenses to worry about. That changed once I decided to remodel my parents in law unit. What I thought would cost $25,000 ended up costing $41,000. It was the most money I had spent in a four-week period since remodeling a prior home from 2019 to 2022.

As I watched the bills pile up, I became acutely aware of every cost around me. When expenses rise, cash flow available for everything else shrinks. And one of the few truly flexible expenses left was food.

As a result, I intentionally decided to spend less on food to improve cash flow. For example, instead of spending $25 for an extra container of poke from Fresh Catch, we made due with less. The funny thing is, in the end, my parents ended up footing 85% of the remodel bill. I just didn’t expect them to, which is why I lowered my expenses.

Related: Everything Is Rational – The Answer To All Things Irrational

A Careful Inspection Of Our Food Budget

When we returned from Hawaii, I finally examined our food spending closely and was stunned. We were spending around $3,500 a month on food for a family of four. I was shocked.

Although I manage our investments and generate supplemental retirement income through this site and book writing, I do not actively manage our household expenses.

In my head, I believed we were spending around $2,500 a month on food. Inflation that accelerated after 2021 changed everything. Even though headline inflation has moderated, our food costs are still roughly 40 percent higher than they were five years ago.

Mentally, I was stuck in a much earlier pricing era until I confronted the actual numbers. Inflation has a great way of sneaking up on us.

Adding Substitution To Lose Weight

Anchoring to outdated price memories is why all of us should conduct a deep financial review at least once a year. What we remember is often disconnected from present reality.

This is the same anchoring mistake many older generations make when they say things were cheap back in their day and that working harder was all it took. They underestimate the compounding impact of inflation relative to wages.

Once I understood our true spending, my wife and I created a monthly food plan. Our target was to return to $2,500 a month and save $1,000 a month while eating healthier. That meant eating less, but also substituting.

The biggest substitution: going from food delivery to more home-cooked meals.

Living in San Francisco, a top three food city in the country, makes this harder. We build the technology that makes food delivery convenient. We are also surrounded by hundreds of excellent restaurants across every cuisine imaginable, all deliverable within an hour.

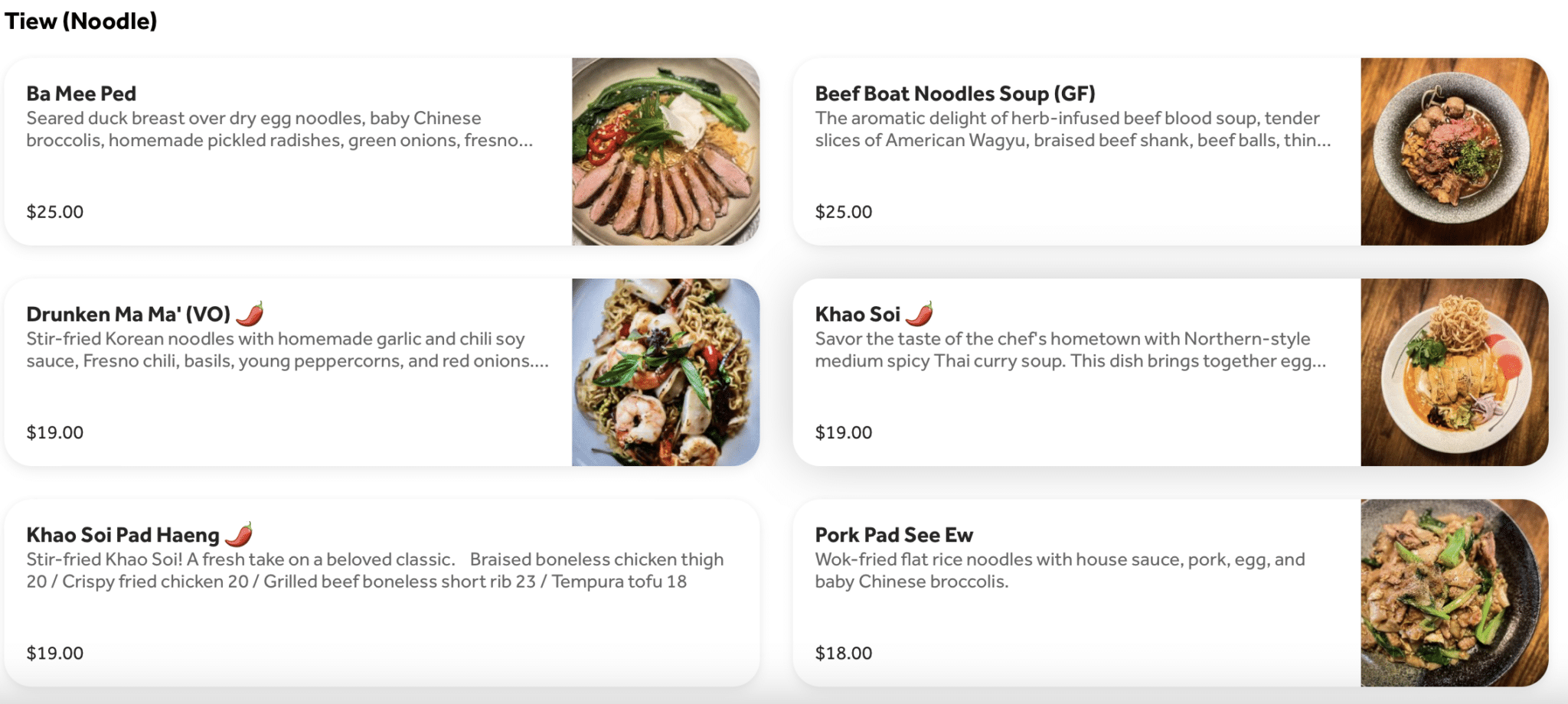

In fact, I recently discovered a restaurant called Khao Tiew that serves the best khao soi I’ve ever had. Unfortunately, once you add boneless beef short rib, tax, and tip, the dish runs about $28 for pickup. So for now, I’ve replaced it with $1.49 instant ramen noodles and call it a lesson in discipline. Substitution baby!

Write Out Your Reasons For Wanting To Lose Weight

After running through your budget and deciding how much to reduce and what to substitute, it’s finally time to write out the reasons why you want to lose weight. Because once you have a why, you can do almost anything.

My reasons are:

- Boost cash flow by $1,000 a month as I prepare for tougher times ahead due to AI.

- Reduce total cholesterol by 50 points before my next physical in six months.

- Stay trim like my dad so I can live to age 80+ and have my kids visit me with hugs and kisses like when they were young.

- Reduce impact on my knees and joints when playing supports in order to feel better every day.

- Continue fitting into the same clothes I’ve worn for the past 25 years, saving money and sparing myself the time and annoyance of shopping for new ones.

The Final Financial Kick in the Rear to Lose Weight

By mid-October, three months in, my weight dropped from 173 pounds to 168 pounds. I felt good about the progress because I was no longer just losing water weight. It felt real.

Then Business Insider came by to interview me about saving money while raising a family. When I saw myself on camera, I felt newly motivated to keep losing weight. As cliché as it sounds, the saying is true: the camera really does add 10 pounds.

After the video came out, I could suddenly empathize with actors and celebrities who obsess over fitness, weight-loss drugs, cosmetic procedures, and extreme diets. When your image affects your livelihood and future opportunities, the pressure to look your best is intense and understandable.

The experience also reinforced my desire to not pursue video to not fall into the trap of external validation. So it’s back to writing and podcasting for me, where the focus is on ideas rather than appearances. But if you want motivation to lose weight, film yourself and watch it.

Thank Goodness For Higher Food Prices And A Turbulent Economy

If food prices were falling, food consumption would logically rise. Good food is hard to resist. But when I watched my favorite steak at the supermarket go from $28 a pound to $32 and then $39, I stopped buying it. First I substituted with a $12 cheeseburger from Super Duper. Then I began reducing the consumption of meat altogether.

As delivery fees and menu prices climbed, opting out altogether became simpler. Meals that once cost under $85 for our family of four now routinely exceed $140. At that point, rice porridge with chicken and cabbage for $25 covering two days sounded great.

Now that I am used to a flatter stomach, I have no desire to go back. My endurance on the court has improved and I feel fitter overall. As Steven Tyler once said, “nothing tastes as good as skinny feels.”

Although paying more for food is unpleasant, I am oddly grateful. For too long, I lived comfortably without scrutinizing my food spending and ate whatever I wanted. This is the problem with living in America, where everything is full of abundance.

By eating less, I not only lost weight but also improved my financial discipline. Maybe I’ll even reach 155 pounds one day, like I was in high school, and live to 80 like my dad.

Who am I kidding? 155 pounds is too light. I’m happy staying around 165 pounds, plus or minus two, for the rest of my life. Fight on!

Readers, have you adjusted your consumption or substituted away from higher priced foods as prices surged? How have your habits changed since the pandemic? Are you a rational economist and PF nerd who adjusts behavior to prices?

Suggestions For A Better Life

Ultimately, the goal of losing weight is to feel healthier and live longer. Whether you succeed or not, you can at least protect your family with an affordable life insurance policy through Policygenius. My wife and I both secured matching 20 year term life insurance policies during the pandemic to protect our two young children, and once we did, a tremendous amount of financial worry disappeared.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009.

For background, I was an Economics major at The College of William and Mary and have always loved the subject. If I had not gone into equities, I likely would have pursued fixed income instead. The single most important economic indicator I follow is the 10 year bond yield. The risk free rate tells us an enormous amount about growth, inflation expectations, and risk.

Read the full article here